Subscriptions are non-refundable and may not be cancelled during an active subscription period. You can manage your subscriptions and turn off auto-renew by going to your Account Settings after purchase. Your iTunes account will be charged a renewal price equal to that of the original subscription within 24 hours prior to the end of the current period. All subscriptions will AUTOMATICALLY renew unless auto-renew is turned off at least 24 hours prior to the end of the current period. Subscription purchases are charged to your iTunes account upon confirmation of the purchase.

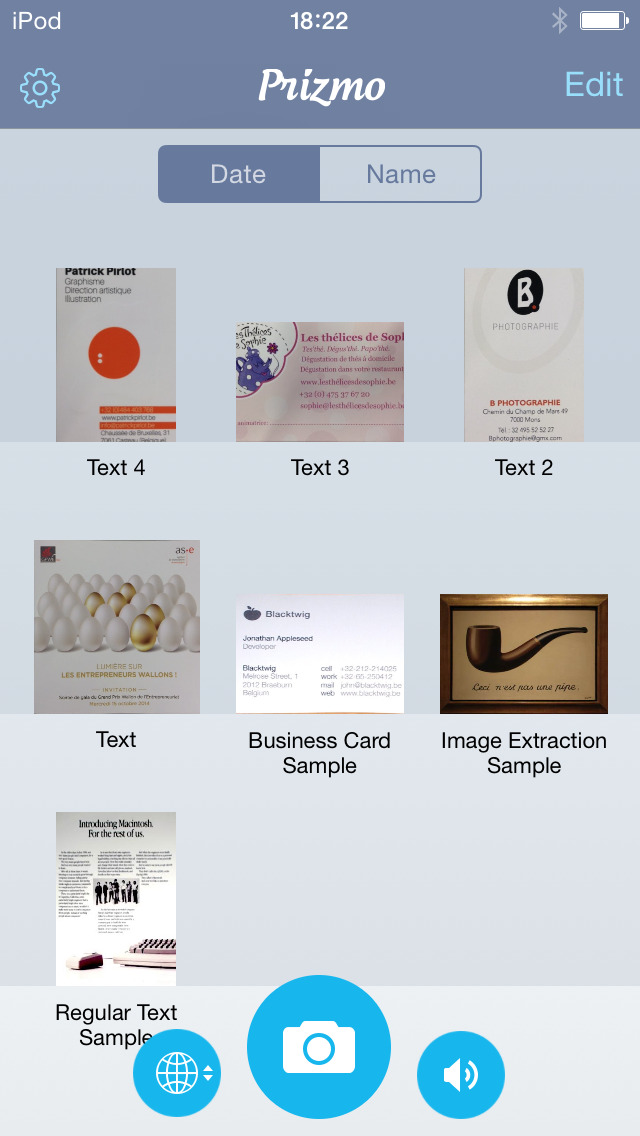

#Prizmo app ipad Offline#

Features: No Ads, offline study (download images, sound for offline usage), unlimited text-to-speech, online cloud storage of all your data (card-set, progress, …). Annual auto-renewable subscription with 9.99$

All of this in an elegant and intuitive user experience. Using iCloud, you can even shoot the picture on your iPhone, and finish editing on your iPad or Mac. Features: No Ads, offline study (download images, sound for offline usage), limited text-to-speech (30 times of use for each session) Prizmo relies on state-of-the-art technologies, like a highly accurate OCR, real-time page detection, and beautiful image cleanup. Annual auto-renewable subscription with 4.99$ We offer Basic and Premium Subscription packages that remove Ads and unlock unlimited access to our app. IMPORTANT BASIC AND PREMIUM SUBSCRIPTION INFORMATION: If you haven’t tried our app, please try it. Analysing automatically results and rankings of users Adapting automatically to the levels of users. Instead of the traditional learning with books, the brain is also challenged via our several learning modes: Study, Slide show, Matching, Memorize, Quiz to make the process for you study more exciting and fun.ĬPA includes 5000 Flashcards and Practice Questions which cover all aspects of the Certified Public Accountant exam: We offer studying tools for any subjects, purpose learning materials for everyone from everywhere.

CPA practice test is a great way to help you prepare for CPA exam.

0 kommentar(er)

0 kommentar(er)